Business partner life insurance if you are looking for a fast free insurance quote then get reliable information from a trusted provider. Business partner life insurance is just like any other life insurance you buy.

Commercial Insurance Medlin Associates

Commercial Insurance Medlin Associates

While business partner life insurance is a term life contract it may different from the traditional contract.

Business partner life insurance. Investing in life insurance for business partners is essential if you want your business to survive a partners untimely death or disability. Life insurance is an important way for small business owners to protect their investments their partners and their families. By running a life insurance policy through the business you can save money.

Life insurance is an ideal choice because it guarantees that the required amount of money will be available precisely when its needed. Purchasing insurance can be a cost effective funding option for a buy sell agreement. Business partners who arent related should have a buy sell agreement from day one says meg muldoon assistant vice president of advanced sales with penn mutual life insurance co.

For example a cross purchase plan covering two partners would require that each partner own pay the premium for and be the beneficiary of a life insurance policy on the life of the other partner. You can also have business partner life insurance that names the surviving partner or the business as the beneficiary of the policy. Hi if my business partner and i buy a permanent life insurance and after 10 years we dissolved the business and each take their own insurance each became the owner of their own insurance policy and change beneficiary to their family member what are the tax complications.

And the benefits of relevant life insurance can save you huge amounts on tax. What if your business partner died tonight. Save money and claim life insurance as a business expense.

Surviving owners pay dollar for dollar plus interest for the deceaseds outstanding share of the business. Heres what you might need. There are lots of different types of life insurance that fall within the umbrella term of business life insurance to provide the cover you need in a policy that protects your company.

Business life insurance can support your business financially if something happens to your staff your partners or you. The insurance company agrees to pay the deceased partners beneficiary a specific amount of money. Key man insurance can help you save on corporation tax or tax on the payout depending on how the money is used.

Dont wait any longer.

What Is An Irrevocable Life Insurance Trust Business Partner Life

Max Life Insurance Manager Human Resources 5 9 Yrs Mp

Max Life Insurance Manager Human Resources 5 9 Yrs Mp

Sap Collections And Disbursements Fs Cd Overview Of Fs Cd

Sap Collections And Disbursements Fs Cd Overview Of Fs Cd

Protecting Your Business Partner Investment With Life Insurance

Protecting Your Business Partner Investment With Life Insurance

Buy Sell Agreements Rethinking The Role Of Life Insurance In 2019

Buy Sell Agreements Rethinking The Role Of Life Insurance In 2019

Lic Advisor Service And Lic Financial Consultant Service

Lic Advisor Service And Lic Financial Consultant Service

Associate Business Partner Of Max Life Insurance Killed In Road

Associate Business Partner Of Max Life Insurance Killed In Road

The Life Insurance Industry Needs A Lifeline Brink The Edge Of

The Life Insurance Industry Needs A Lifeline Brink The Edge Of

What Is An Irrevocable Life Insurance Trust Business Partner Life

What Is An Irrevocable Life Insurance Trust Business Partner Life

What Is An Irrevocable Life Insurance Trust Business Partner Life

What Is An Irrevocable Life Insurance Trust Business Partner Life

Explained Buy Sell Agreement Life Insurance For Business

Explained Buy Sell Agreement Life Insurance For Business

Key Considerations For Business Owners Disability Income Products

Key Considerations For Business Owners Disability Income Products

Make Life Insurance Your Business Partner Penn Mutual

Make Life Insurance Your Business Partner Penn Mutual

Life Insurance Businessperson Company Png 700x530px Insurance

Life Insurance Businessperson Company Png 700x530px Insurance

Do I Really Need Life Insurance Simple Money Mom

Do I Really Need Life Insurance Simple Money Mom

The Penn Mutual Life Insurance Company Announces New Managing

The Penn Mutual Life Insurance Company Announces New Managing

Which Life Insurance Policy Is Best For Your Family Confident

Pin By Maris On Insurance Life Insurance Quotes Life Insurance

Pin By Maris On Insurance Life Insurance Quotes Life Insurance

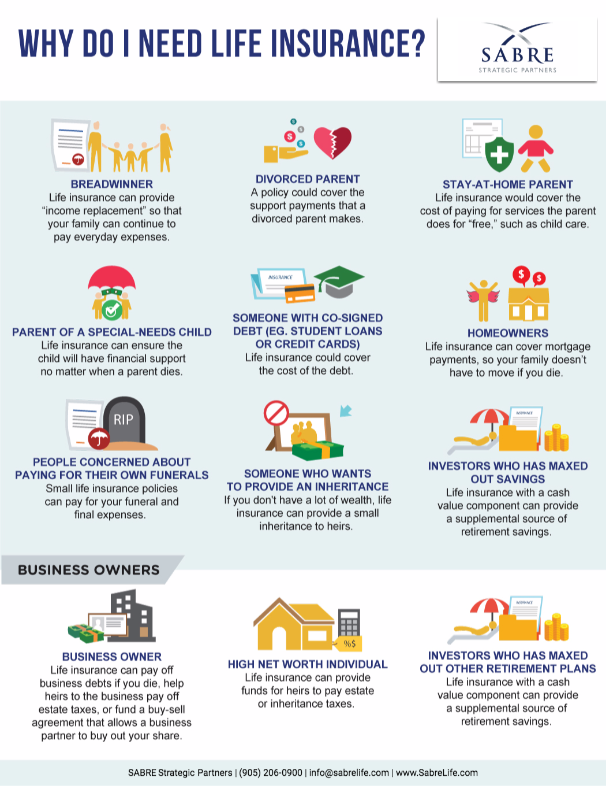

Do You Really Need Life Insurance Sabre Strategic Partners

Do You Really Need Life Insurance Sabre Strategic Partners

Managing Agency Partner Life Insurance Zippyera Business

Managing Agency Partner Life Insurance Zippyera Business

Sap Collections And Disbursements Fs Cd Overview Of Fs Cd

Sap Collections And Disbursements Fs Cd Overview Of Fs Cd

Make Life Insurance Your Business Partner Penn Mutual

Make Life Insurance Your Business Partner Penn Mutual

Life Insurance Today S Learning Objective How Does Life Insurance

Life Insurance Today S Learning Objective How Does Life Insurance

Comments

Post a Comment