If youve been divorced yourself you know the end of a marriage can really run someone through the emotional ringer. You can now run quotes to and even apply for life insurance completely online.

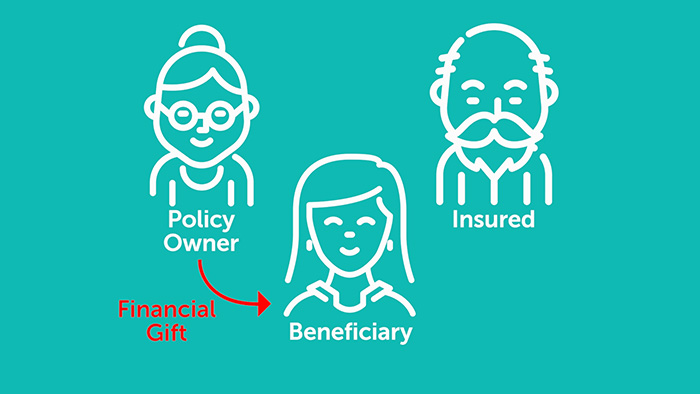

Beneficiaries can be of two types.

Beneficiary on life insurance policy. Revocable and irrevocable life insurance beneficiaries. Listing your life insurance policies in your will can help loved ones to know that the coverage exists and can point them in the right direction in terms of collecting the benefit. A beneficiary is an individual institution trustee or estate which receives or may become eligible to receive benefits under a will insurance policy retirement plan trust annuity or other contract.

Its important however to know that regardless of what your will says the life insurance money will be paid to the beneficiary listed on the life insurance policy. No one likes to think about dying but a life insurance policy can be a critical tool of transition for your loved ones. When you purchase a life insurance policy you choose the beneficiary of the policy.

The beneficiary of a life insurance policy is the entity that will receive the proceeds should the person insured under the policy die. It is important to understand which type of beneficiary your policy has as life circumstances change over time and there. Many professionals in the industry feel that the best or safest approach is to name a primary beneficiary and a contingent beneficiary on a life insurance policy.

Who becomes the beneficiary of a life insurance policy if the beneficiary is dead. 5 beneficiary mistakes people can make on their life insurance policy and retirement plans. Your beneficiary may be for example a child or a spouse.

If there are the proceeds will be divided among these co beneficiaries. There are two classes of beneficiaries known as revocable and irrevocable beneficiaries. The insurance company will determine if there are primary co beneficiaries named in the policy.

So talk to your spouse. Questions to consider about your spouses life insurance. Life insurance or any insurance isnt on most peoples minds when theyre watching their life crumble apart.

Its important to understand what a beneficiary is and how your life insurance policy works so you can come up with the best strategy to protect them. A life insurance beneficiary is the person or entity that will receive the money from your policys death benefit when you pass away. Generally speaking when the beneficiary of a life insurance policy receives the death benefit this money is not counted as taxable income and the beneficiary does not have to pay taxes on it.

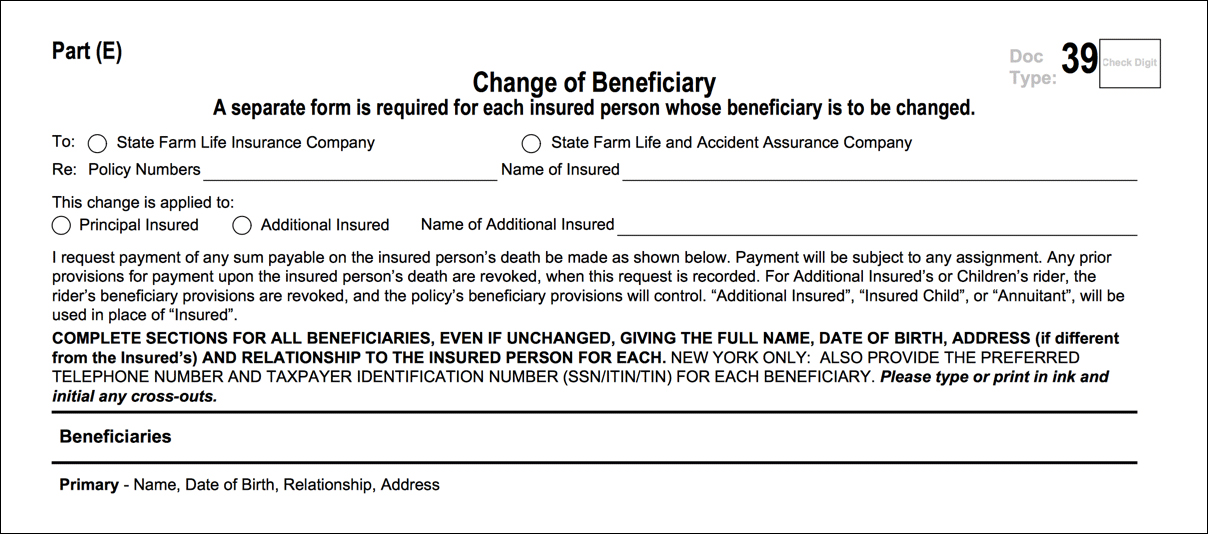

How to change your life insurance beneficiary and why you should times have started to shift as the internet has empowered you to research and decide what you need for life insurance.

Download Designating A Beneficiary For Life Insurance Docshare Tips

Download Designating A Beneficiary For Life Insurance Docshare Tips

Naming Multiple Life Insurance Policy Beneficiaries Quotacy S

Naming Multiple Life Insurance Policy Beneficiaries Quotacy S

How To Name A Beneficiary For Your Life Insurance Policy Ripea

How To Name A Beneficiary For Your Life Insurance Policy Ripea

Life Insurance Payout How To Be Sure Your Beneficiary Gets Paid

Life Insurance Payout How To Be Sure Your Beneficiary Gets Paid

Supreme Court Upholds Minnesota Law That Invalidated Ex Wife As

Supreme Court Upholds Minnesota Law That Invalidated Ex Wife As

Beneficiary Review Client Letter

Beneficiary Review Client Letter

Metlife Direct Life Insurance Sample Letter To Life Insurance

Metlife Direct Life Insurance Sample Letter To Life Insurance

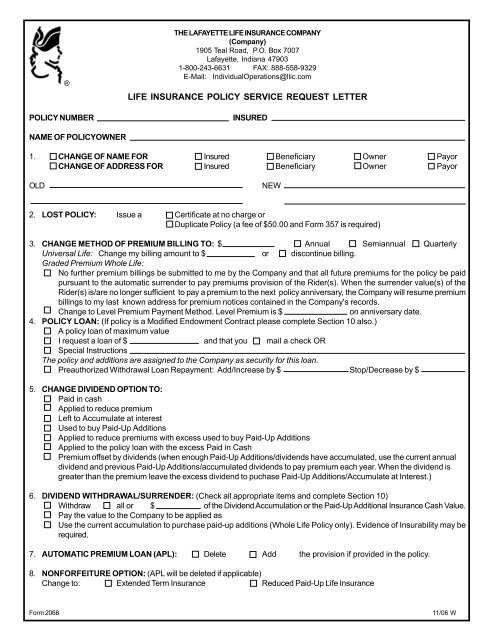

Life Insurance Policy Service Request Letter Secure Your Future

Life Insurance Policy Service Request Letter Secure Your Future

About Life Insurance Beneficiaries Scott W Johnson Medium

About Life Insurance Beneficiaries Scott W Johnson Medium

Monumental Life Insurance Beneficiary Form Fill Online

Monumental Life Insurance Beneficiary Form Fill Online

Designating A Beneficiary For Life Insurance By Beam Alife Issuu

Designating A Beneficiary For Life Insurance By Beam Alife Issuu

What Is A Beneficiary In A Life Insurance Policy And How To Select

What Is A Beneficiary In A Life Insurance Policy And How To Select

Which Type Of Life Insurance Policy Is Right For Me Visual Ly

Which Type Of Life Insurance Policy Is Right For Me Visual Ly

How To Choose A Life Insurance Beneficiary Lifeinsure Com

How To Choose A Life Insurance Beneficiary Lifeinsure Com

Wes Smith Quote The Chief Beneficiary Of Life Insurance Policies

Wes Smith Quote The Chief Beneficiary Of Life Insurance Policies

Importance Of Life Insurance And Pension Beneficiary Designations

Importance Of Life Insurance And Pension Beneficiary Designations

As Beneficiary On A Life Insurance Policy Can You Be Sued By

As Beneficiary On A Life Insurance Policy Can You Be Sued By

Whole Life Insurance Quotes State Farm Thenestofbooksreview

Whole Life Insurance Quotes State Farm Thenestofbooksreview

Life Insurance Policies How Payouts Work

Life Insurance Policies How Payouts Work

3 Things You Need To Know About Being A Life Insurance Beneficiary

3 Things You Need To Know About Being A Life Insurance Beneficiary

What Not To Do When Choosing Life Insurance Policy Beneficiaries

What Not To Do When Choosing Life Insurance Policy Beneficiaries

Comments

Post a Comment