What makes it a basic policy is that it is simple in the fact that you pay for a specific amount of coverage for a certain amount of time. Term life insurance which provides only a death benefit without any cash value component offering the least expensive cost per 1000 of death coverage purchased.

5 Ways Stacking Life Insurance Policies Is A Perfect Idea

5 Ways Stacking Life Insurance Policies Is A Perfect Idea

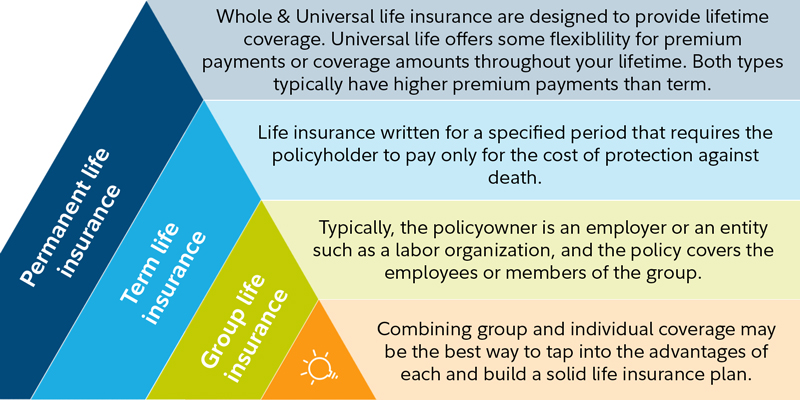

Life insurance may be divided into two basic classes.

Basic life insurance coverage. Federal employees group life insurance. In addition to the basic there are three forms of optional insurance you can elect. Term assurance provides life insurance coverage for a specified term.

Types of life insurance. Or the following subclasses. However your basic life insurance coverage will not be reduced if your base pay decreases for any reason while you are a bp employee.

In most cases if you are a new federal employee you are automatically covered by basic life insurance and your payroll office deducts premiums from your paycheck unless you waive the coverage. It helps you pay for basic medical and dental expenses. Basic life refers to life insurance that would pay the death benefit to the beneficiary if death occurred by any reason except suicide in the first two years.

It comes in four parts basic insurance option a. If your basic life insurance amount exceeds 50000 you can reduce your basic life coverage to 50000 so you do not have to pay imputed income on the coverage. In most cases basic life insurance pays out a benefit to your loved ones but sometimes it wont.

The policy does not accumulate cash. You purchase protection for a certain amount of time after which the policy terminates. Permanent life insurance such as whole life which has a cash value account in which a return on investment component becomes an often complex and.

Read on to learn the ins outs of life insurance coverage. Basic life coverage can be seen as the purest form of a life policy and that is a traditional term life insurance policy. Term insurance without any optional rider is considered to be the most basic type of life insurance.

In most cases basic life insurance pays out a benefit to your loved ones but sometimes it wont. Life insurance policies are divided into two main types. Basic life and add insurance are the names often used when offering supplemental insurance to employees.

Personal health insurance basic plan is our lowest cost option. If you want more benefits with higher coverage limits consider our personal health insurance standard or enhanced plans. Theres one benefit program for federal employees and retirees that doesnt get much attention.

It consists of basic life insurance coverage and three options. Term universal whole life and endowment life insurance.

Types Of The Life Insurance Policy Trendytarzan

Types Of The Life Insurance Policy Trendytarzan

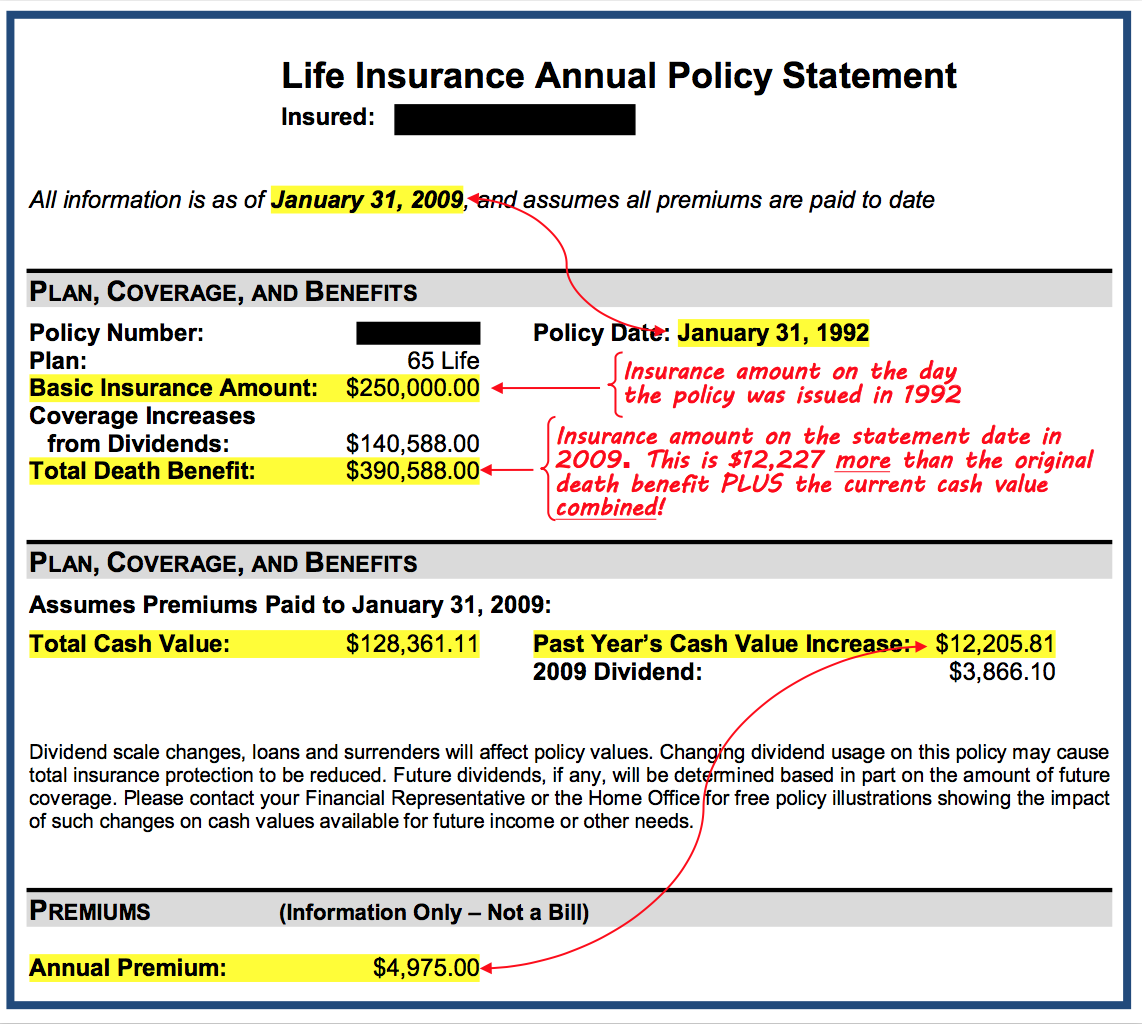

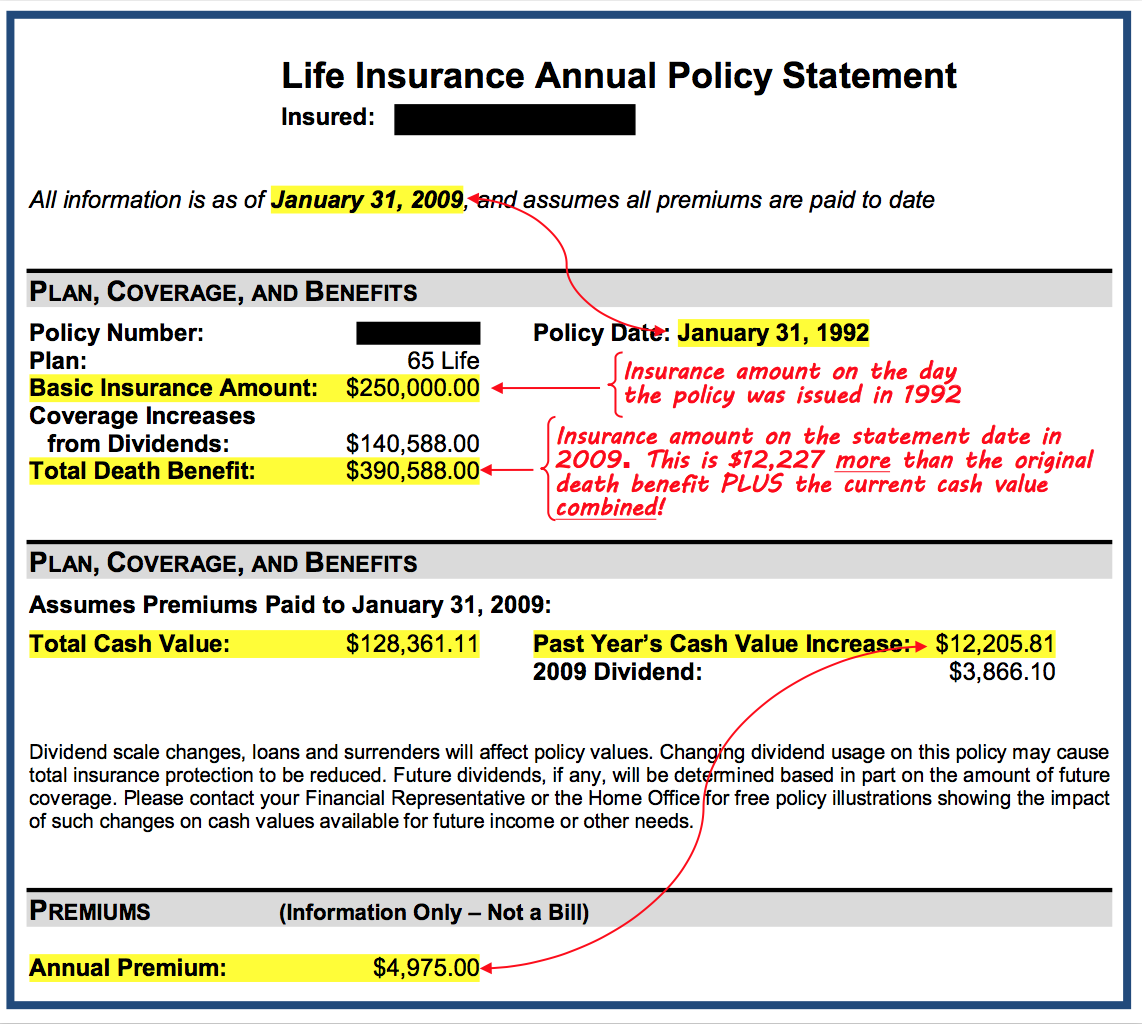

How To Calculate Basic Life Insurance Need Rubach Wealth

How To Calculate Basic Life Insurance Need Rubach Wealth

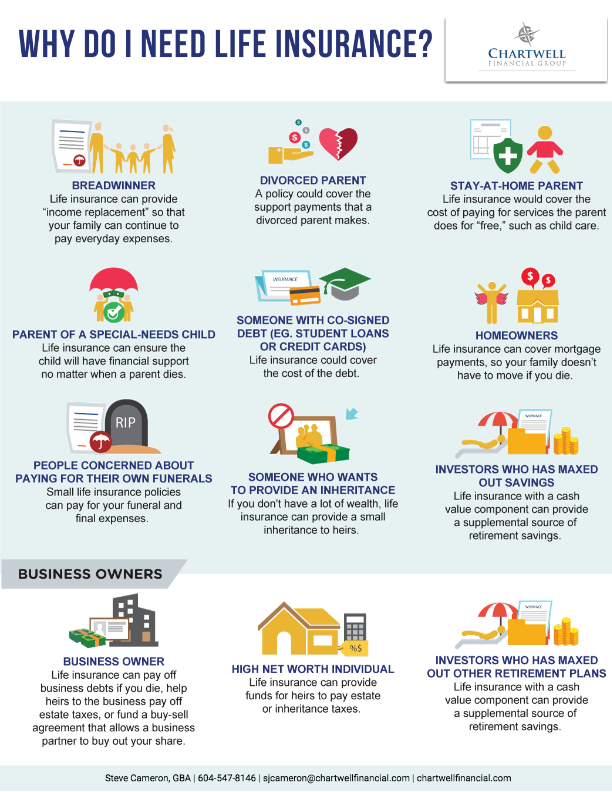

Do You Really Need Life Insurance Chartwell Financial Group

Do You Really Need Life Insurance Chartwell Financial Group

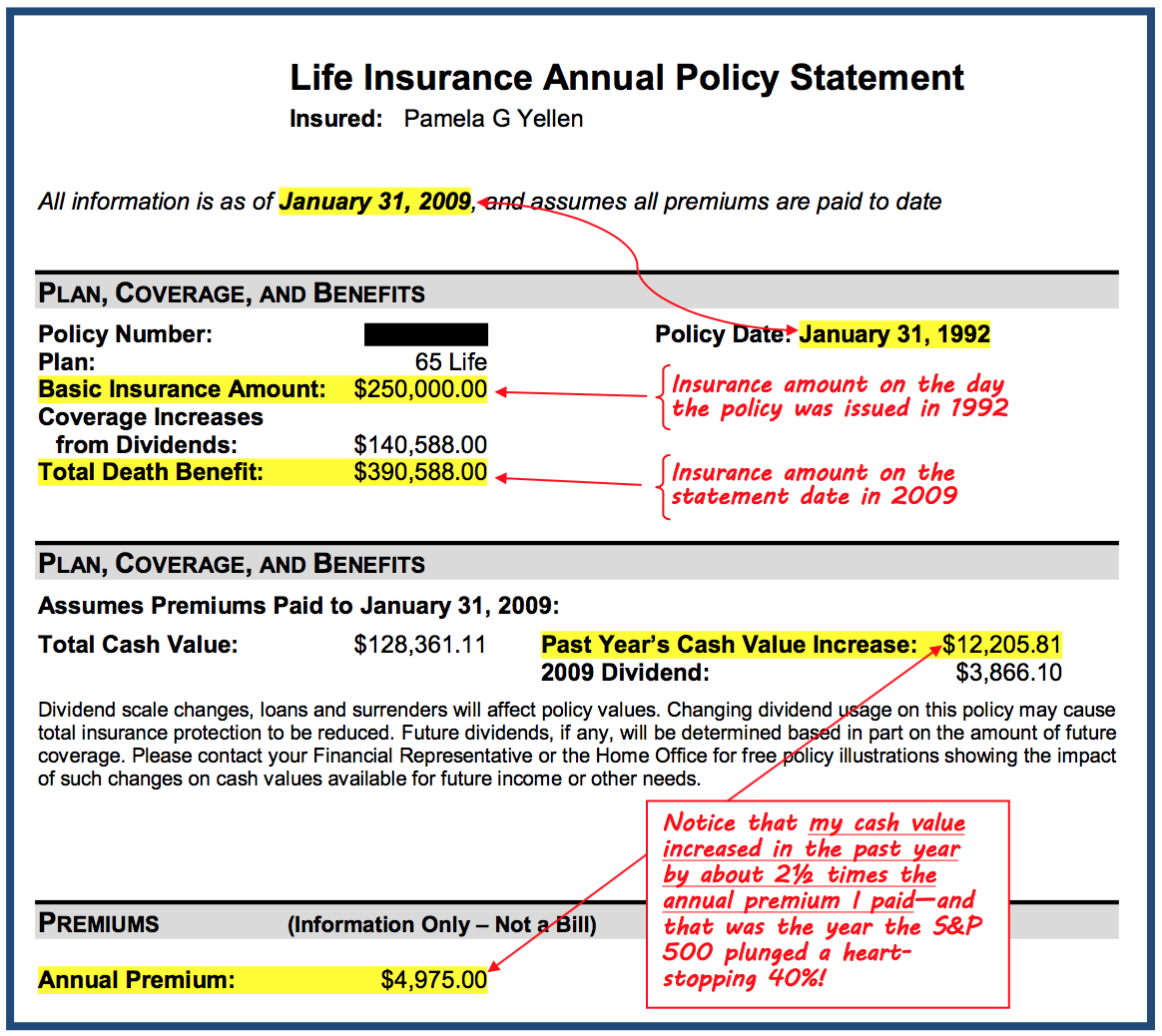

Life Insurance Annual Policy Statement

Life Insurance Annual Policy Statement

Group Life Insurance Group Life Insurance Coverage

Group Life Insurance Group Life Insurance Coverage

8 Ways To Save On Life Insurance Gobankingrates

8 Ways To Save On Life Insurance Gobankingrates

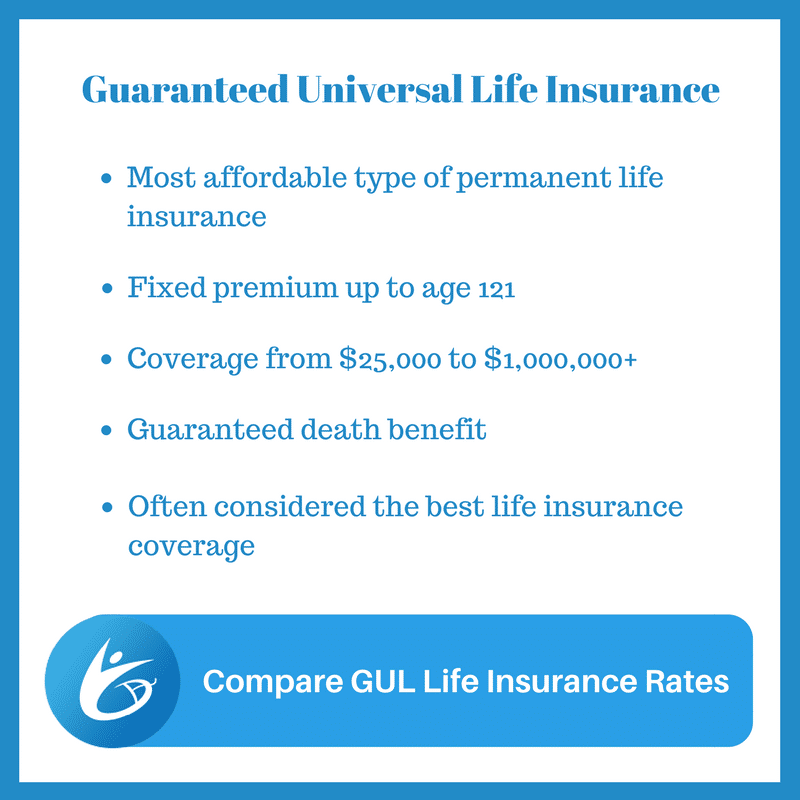

15 Best Guaranteed Universal Life Insurance Companies Reviewed

15 Best Guaranteed Universal Life Insurance Companies Reviewed

Supplemental Life And Ad D Coverage Expanded For 2019 Hub

Supplemental Life And Ad D Coverage Expanded For 2019 Hub

Haven Life Insurance Review 2020 Affordable Life Insurance Cover

Haven Life Insurance Review 2020 Affordable Life Insurance Cover

Layering Life Insurance Policies Fidelity Investments

Layering Life Insurance Policies Fidelity Investments

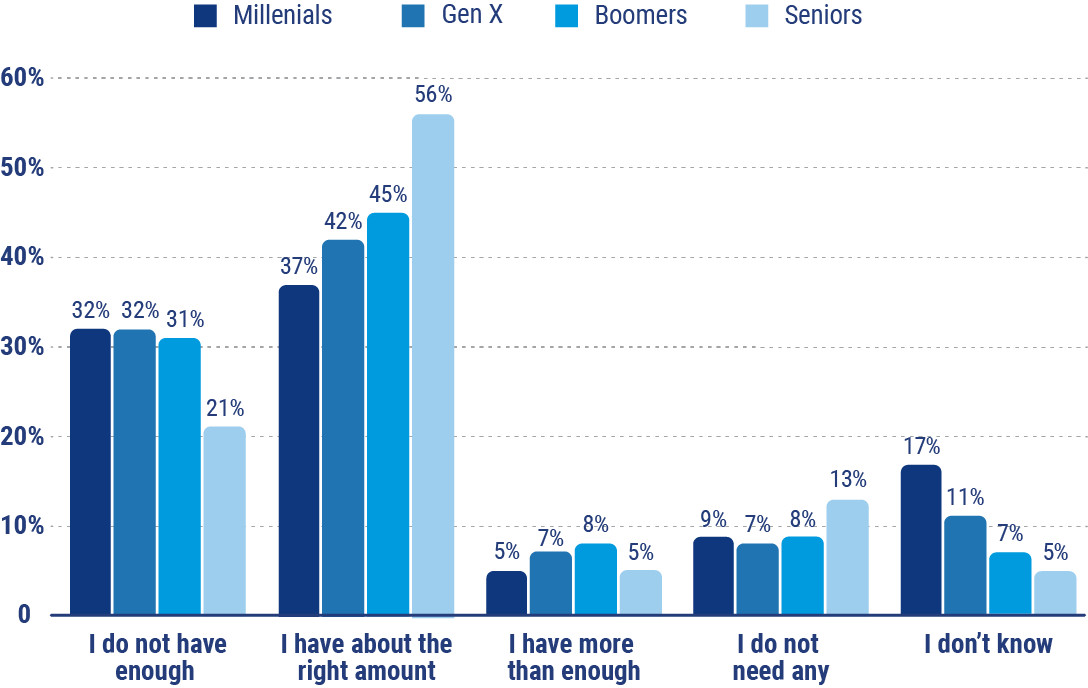

Life Insurance Adequacy Rice Warner

Life Insurance Adequacy Rice Warner

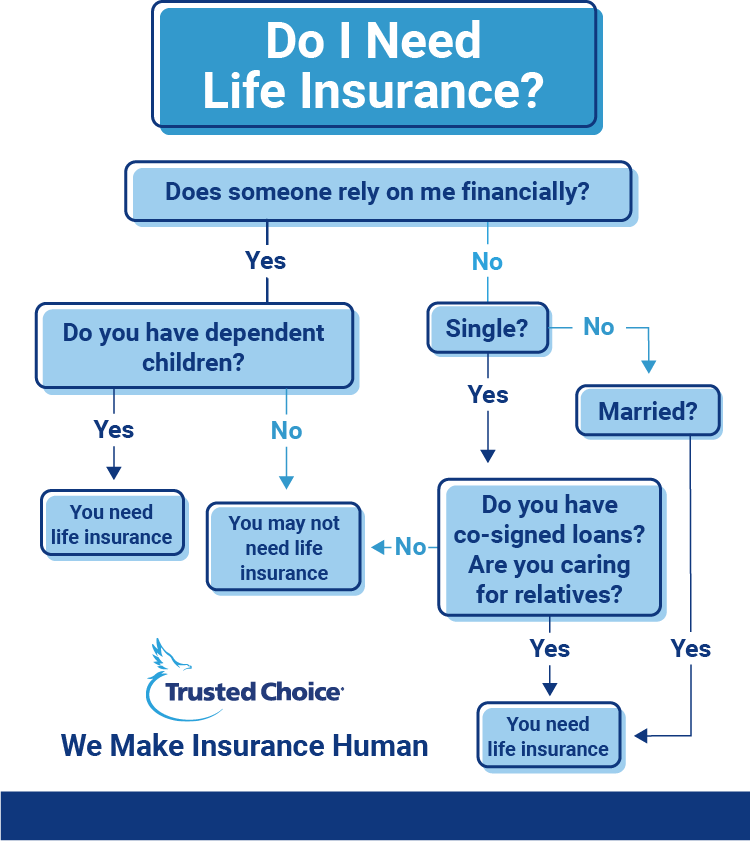

Life Insurance Facts Policies Quotes Trusted Choice

Life Insurance Facts Policies Quotes Trusted Choice

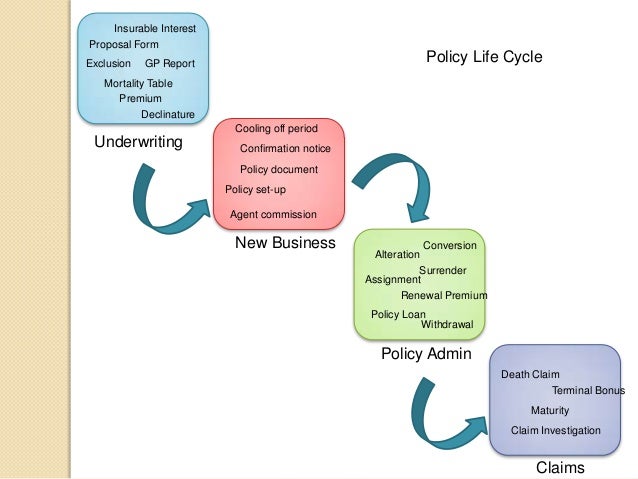

Life Insurance Basic Concepts United Kingdom

Life Insurance Basic Concepts United Kingdom

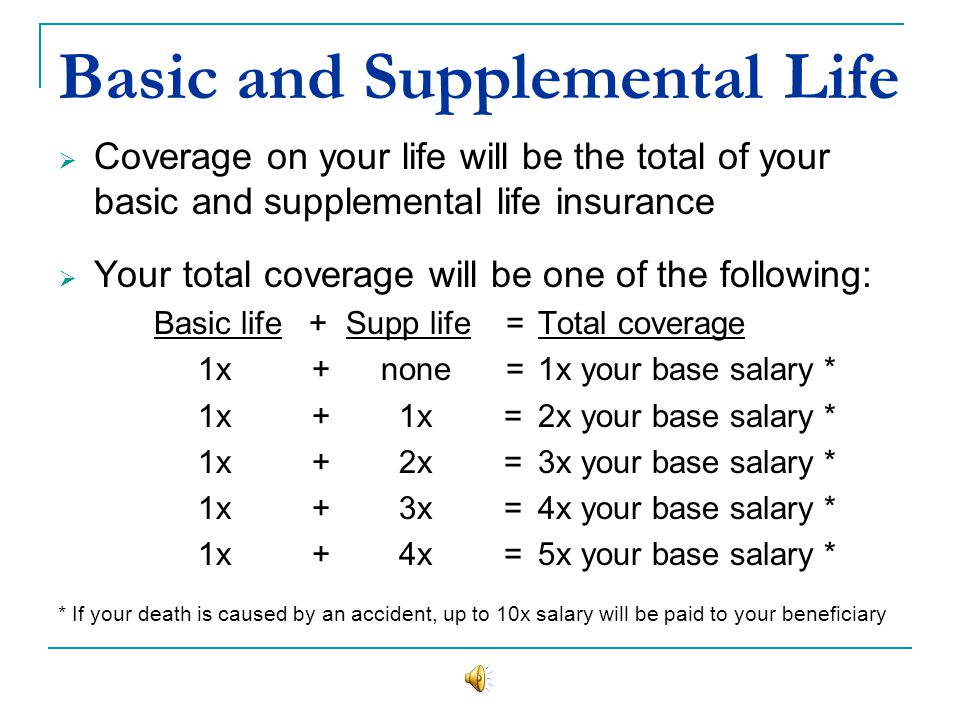

Life Insurance Human Resource Services

Life Insurance Human Resource Services

Term Insurance Best Term Plans Policy Online In India 2020

Term Insurance Best Term Plans Policy Online In India 2020

State Life Insurance Corporation Of Pakistan Shadabad Plan Table

State Life Insurance Corporation Of Pakistan Shadabad Plan Table

What Type Of Life Insurance Policy Is Best For Me

What Type Of Life Insurance Policy Is Best For Me

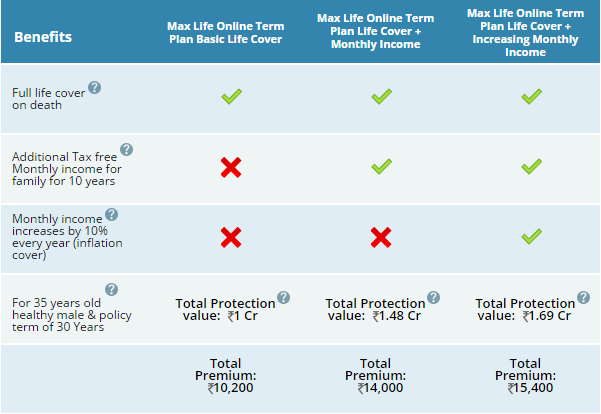

Max Life Online Term Plan Ideal Plan To Safeguard Your Family S

Max Life Online Term Plan Ideal Plan To Safeguard Your Family S

Complete Guide To Life Insurance Pt 1 The 5 Basic Attributes

Complete Guide To Life Insurance Pt 1 The 5 Basic Attributes

Life Insurance Overview Of Life Insurance Coverage Ppt Download

Life Insurance Overview Of Life Insurance Coverage Ppt Download

Comments

Post a Comment