In most cases life insurance proceeds are not taxable so your beneficiaries should get the full amount available under. Life insurance isnt a fun topic to think about but it can protect your loved ones in the event you were to pass away.

How A Life Insurance Payout Actually Works Mason Finance

How A Life Insurance Payout Actually Works Mason Finance

Generally speaking when the beneficiary of a life insurance policy receives the death benefit this money is not counted as taxable income and the beneficiary does not have to pay taxes on it.

Are life insurance proceeds taxable to beneficiary. First if the death benefit is paid to the estate of the insured then the whole amount of the death benefit is included in the estate and subject to estate tax. If you are considering this seek advice from a tax professional. However any interest you receive is taxable and you should report it as interest received.

When you purchase life insurance the money your beneficiary receives when you pass away are referred to as death benefits unlike the cash available from a whole life policy whether it is. As the beneficiary of a life insurance policy it is very important to know whether or not you will need to pay taxes on any proceeds received from a life insurance policy. Proceeds from life insurance policies are generally not taxable to the recipient unless the contract itself has been sold or there is something unusual about the policy.

Finally if you sell your life insurance policy to another person while you are alive the proceeds paid to the beneficiary at your death could be considered taxable income to that beneficiary. See topic 403 for more information about interest. Because life insurance proceeds are generally paid out as one lump sum payment its very common to assume that taxes will need to be paid on the money received.

Most of the time proceeds arent taxable. Life insurance companies also sell certain financial products that are sometimes marketed as life insurance policies but do not meet the strict legal definition of such. But there are certain.

Life insurance proceeds are not taxable with respect to income tax so long as the proceeds are paid out entirely as a lump sum one time payment. Life insurance can give your loved ones financial security should you die. Generally life insurance proceeds you receive as a beneficiary due to the death of the insured person arent includable in gross income and you dont have to report them.

However if your beneficiary receives the life insurance payment as a series of installments the insurer will typically pay interest on the outstanding death benefit. The death benefits paid on life insurance policies are subject to estate tax in two situations.

Do The Beneficiaries Of Life Insurance Have To Pay Inheritance Tax

Do The Beneficiaries Of Life Insurance Have To Pay Inheritance Tax

Is Life Insurance Taxable True Blue Life Insurance

Is Life Insurance Taxable True Blue Life Insurance

Should My Trustee Be The Beneficiary Of My Life Insurance Policy

Should My Trustee Be The Beneficiary Of My Life Insurance Policy

Income Tax On Life Insurance Benefits And Annuities Finance Zacks

Income Tax On Life Insurance Benefits And Annuities Finance Zacks

Https Www Irishlife Ie Sites Retail Files Bline Content Cat And S72 Faq Pdf

Protecting Life Insurance Proceeds An Irrevocable Life Insurance

Protecting Life Insurance Proceeds An Irrevocable Life Insurance

Life Insurance Policies How Payouts Work

Life Insurance Policies How Payouts Work

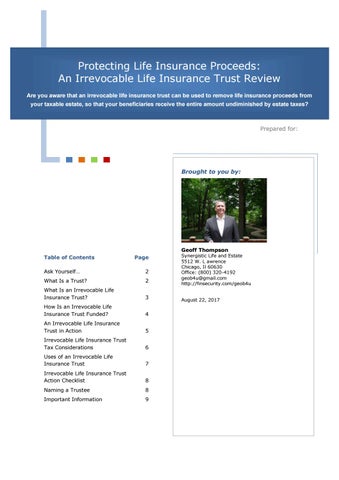

Tax Exempt Life Insurance Investment

Tax Exempt Life Insurance Investment

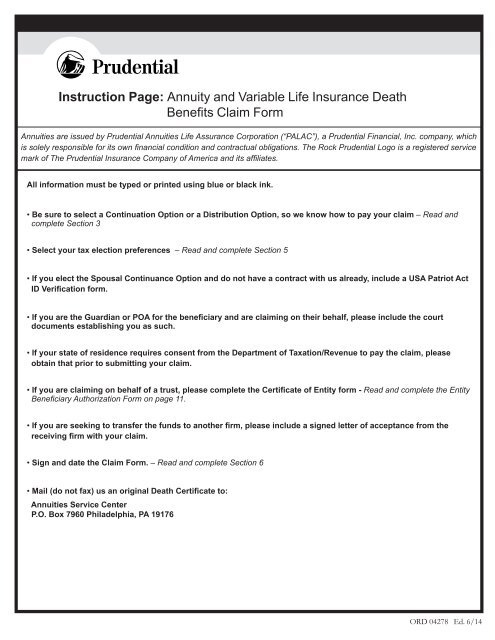

Annuity And Variable Life Insurance Death Benefits Claim Form

Annuity And Variable Life Insurance Death Benefits Claim Form

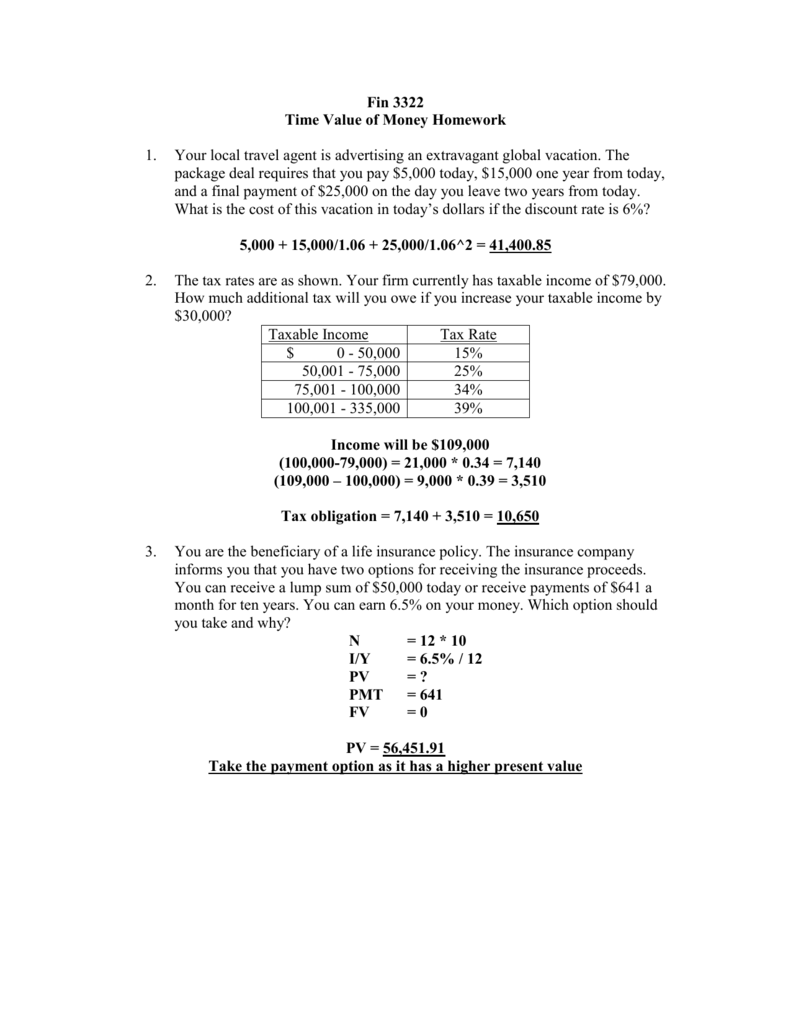

Estate Planning Estate Tax Life Insurance Annuities

Estate Planning Estate Tax Life Insurance Annuities

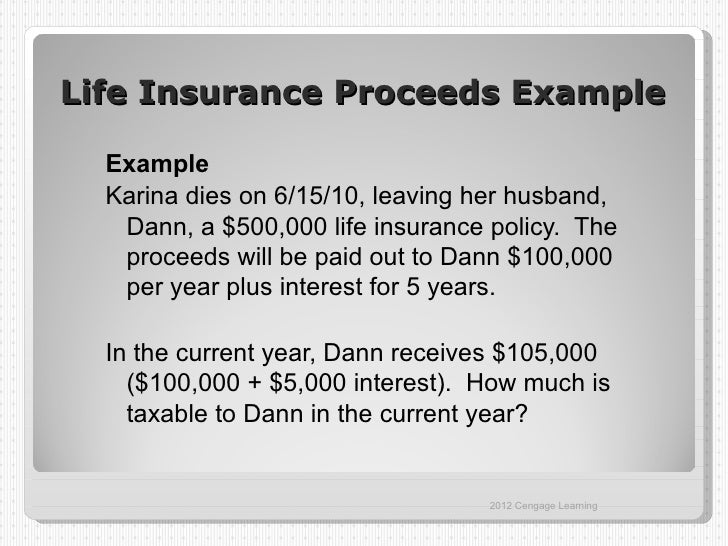

Chapter 10 Life Insurance Ppt Download

Chapter 10 Life Insurance Ppt Download

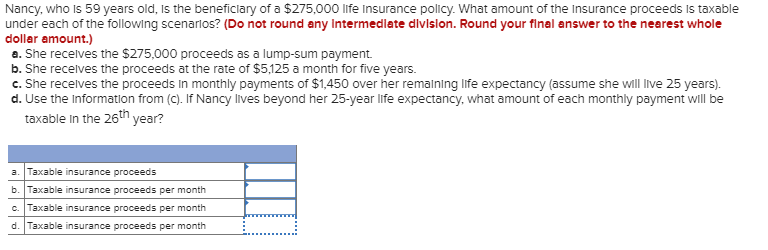

Nancy Who Is 59 Years Old Is The Beneficiary Of Chegg Com

Nancy Who Is 59 Years Old Is The Beneficiary Of Chegg Com

Ultimate Guide In Choosing Beneficiaries For Life Insurance In The

Ultimate Guide In Choosing Beneficiaries For Life Insurance In The

Unwinding An Irrevocable Life Insurance Trust That S No Longer

Unwinding An Irrevocable Life Insurance Trust That S No Longer

When Are Life Insurance Benefits Taxed Texas Republic Life

When Are Life Insurance Benefits Taxed Texas Republic Life

Can The Irs Go After An Insurance Policy With A Beneficiary After

Can The Irs Go After An Insurance Policy With A Beneficiary After

Understanding Charitable Remainder Trusts Estateplanning Com

Understanding Charitable Remainder Trusts Estateplanning Com

Comments

Post a Comment