The selection of such. In the case of insurance adverse selection is the tendency of those in dangerous jobs or high risk lifestyles to purchase products like life insurancein these cases it is the buyer who actually.

Claims Handling Underwriting For Life Insurance Munich Re

Claims Handling Underwriting For Life Insurance Munich Re

Another life insurance example of adverse selection would be a smoker who either does not disclose the fact that he.

Anti selection life insurance. Examples of adverse selection in life insurance include situations where someone with a high risk job such as a race car driver or someone who works with explosives obtain a life insurance policy without the insurance company knowing that they have a dangerous occupation. The adverse impact on an insurer when risks selected have a higher chance of loss than that contemplated by the applicable insurance rate. Anti selection which is also known as adverse selection is the risk that the bad risks will roll to the side of the plate with the kinder more generous insurers like hot potatoes of insurance risk doom and the good risks will end up on the side of the plate with the tougher cheaper insurers or roll off the plate altogether until the spinning stops and the plate falls down.

The term adverse selection refers to the situation when a life insurance company is negatively affected by having different information than their customers. Also known as adverse selection. This reduces profit potential.

Here are the basics of adverse selection and how it can impact life insurance. This has the potential of economic hardship for life insurance companies because those most likely to receive a death benefit are the ones buying policies. Adverse selection in the insurance industry involves an applicant gaining insurance at a cost that is below their true level of risk.

Life insurance companies attempt to counteract adverse selection by limiting coverage andor raising premiums. What a spreadsheet wont tell you about selling life insurance. Adverse selection is also called antiselection.

Adverse selection clinical genetics an. Adverse selection is a problem that every life insurance company has to deal with in one way or another. A smoke getting insurance as a non smoker is an example of.

Advisors know that term conversions are anti selection against the insurance company since typically only policy owners with a health change actually convert their policies. 3 thinking about life insurance through a genetic lens damjan vukcevic jessica chen may 2017 4 genetic testing the threat of anti selection mark lombardo acli symposium on genetics insurance april 2018.

Ch1 2 Overview Of The Financial System Financial Institutions

Ch1 2 Overview Of The Financial System Financial Institutions

The Best Ads Of 2015 The Professionals Pick Their Favourites

The Best Ads Of 2015 The Professionals Pick Their Favourites

Isi Underwriting Guide Pdf Free Download

Isi Underwriting Guide Pdf Free Download

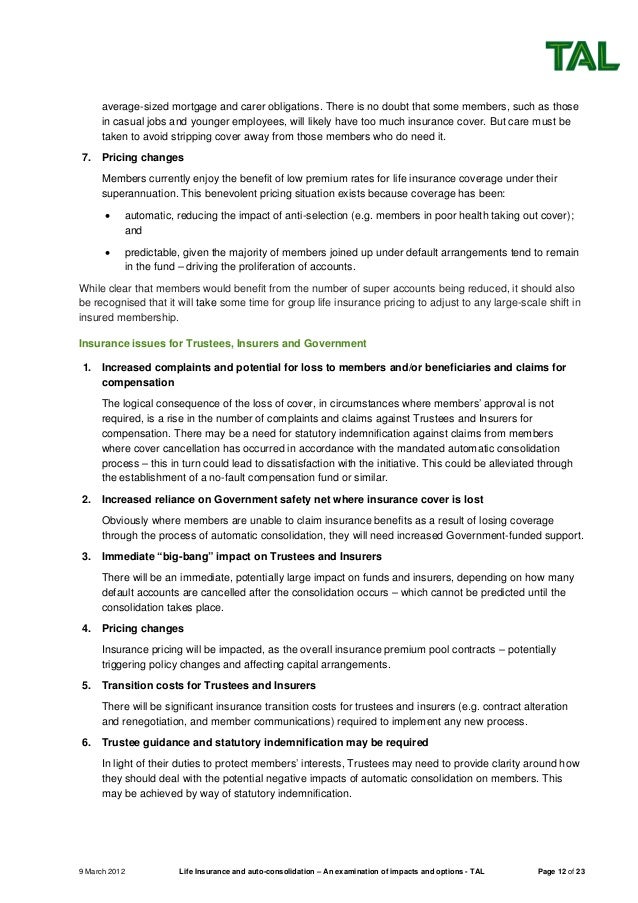

Tal Research Paper Life Insurance Auto Consolidation Final

Tal Research Paper Life Insurance Auto Consolidation Final

Risk Prediction In Life Insurance Industry Using Supervised

Risk Prediction In Life Insurance Industry Using Supervised

Ai Makes Gains In Group Insurance Investment Magazine

Ai Makes Gains In Group Insurance Investment Magazine

A Glossary Of Terms That Insurance Professionals Should Know And

A Glossary Of Terms That Insurance Professionals Should Know And

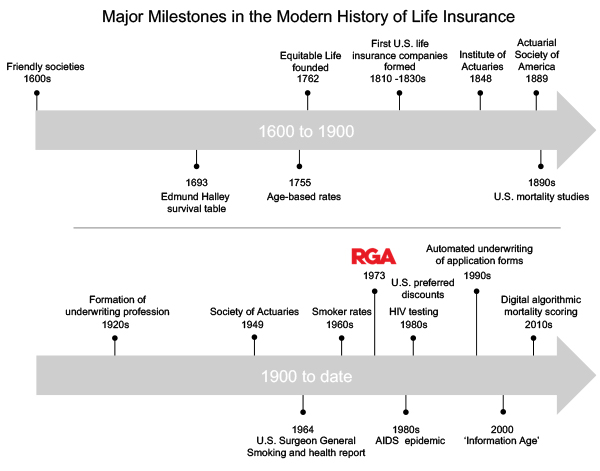

Past Present And Future Of Risk Factors The History Of Life

Past Present And Future Of Risk Factors The History Of Life

States Should Take Additional Steps To Limit Adverse Selection

States Should Take Additional Steps To Limit Adverse Selection

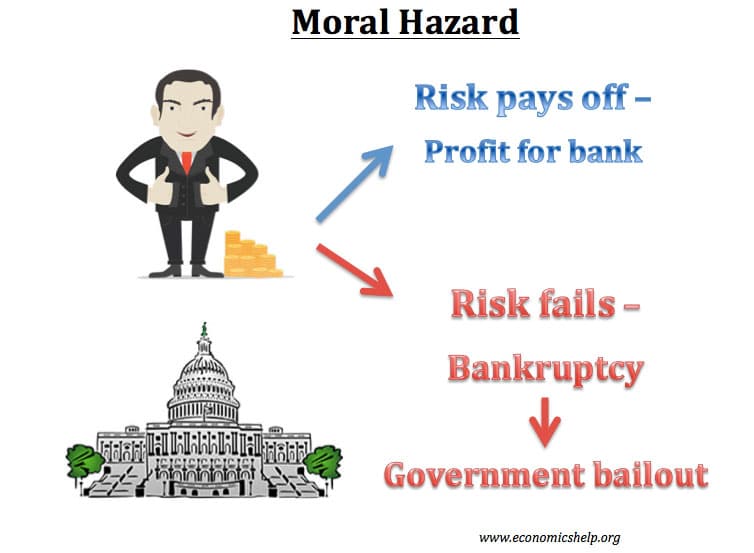

Information Economics Moral Hazard And Adverse Economics Tutor2u

Information Economics Moral Hazard And Adverse Economics Tutor2u

![]() Use Of Genetics In Insurance And Growing Opportunities For Anti

Use Of Genetics In Insurance And Growing Opportunities For Anti

Anti Selection And Insurance What You Should Know

Anti Selection And Insurance What You Should Know

Market Consistent Cash Flows For Benefits Tax And Future Profits

Market Consistent Cash Flows For Benefits Tax And Future Profits

Focus On Voluntary Benefits The Actuary Magazine

Focus On Voluntary Benefits The Actuary Magazine

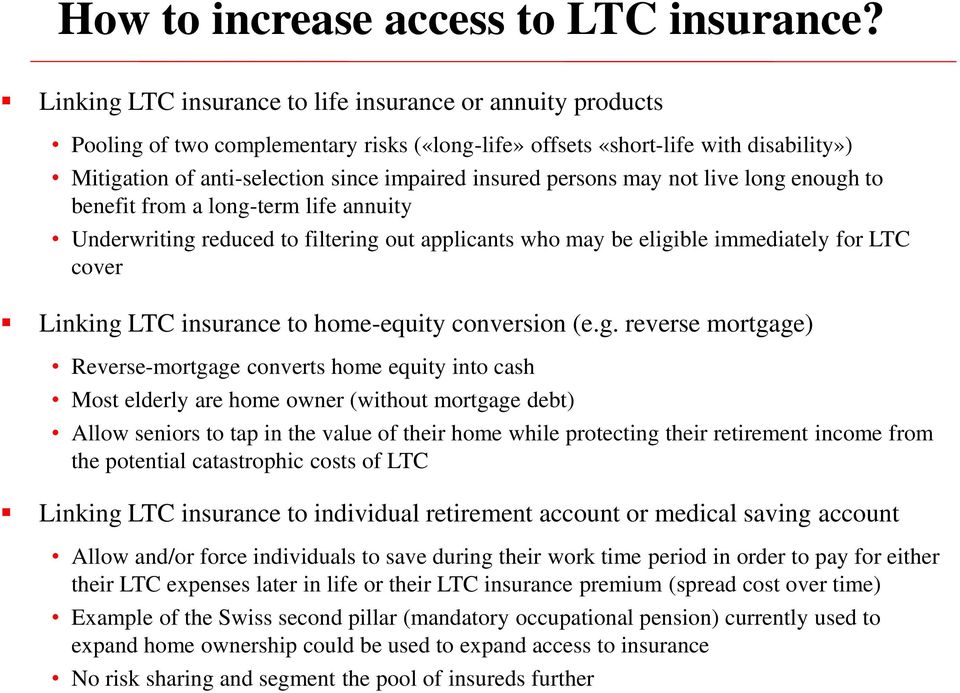

Insuring Long Term Care Needs Christophe Courbage Pdf Free Download

Insuring Long Term Care Needs Christophe Courbage Pdf Free Download

:max_bytes(150000):strip_icc()/modern-skyscrapers-in-business-district-1137991385-d1d5d64ab23946e1b163c1a8915b9ffd.jpg)

Comments

Post a Comment