Generally life insurance of this type allows adjustments in premiums the period of protection and the face amount associated with the policy. Type of policy which allows within certain limits the policyholder to 1 raise or lower the face amount of the policy 2 lengthen or shorten the protection period and the associated premium and 3 change the type of protection.

How Cash Value Builds In A Life Insurance Policy

How Cash Value Builds In A Life Insurance Policy

An adjustable or universal life insurance policy is a policy with premiums that are flexible and death benefits that are adjustable.

Adjustable life insurance definition. Adjustable life insurance is a type of life insurance that allows policyholders to adjust features of the policy as time goes on. Adjustable life insurance is a form of life insurance that allows the policyholder to manipulate the coverage plan in various ways. Adjustable life insurance is a flexible premium adjustable death benefit type of permanent cash value insurance.

This means that you may change your premium payment every month if you want to and you may adjust your death benefits up or down. Its advantages and disadvantages are explored here. Types of adjustable life.

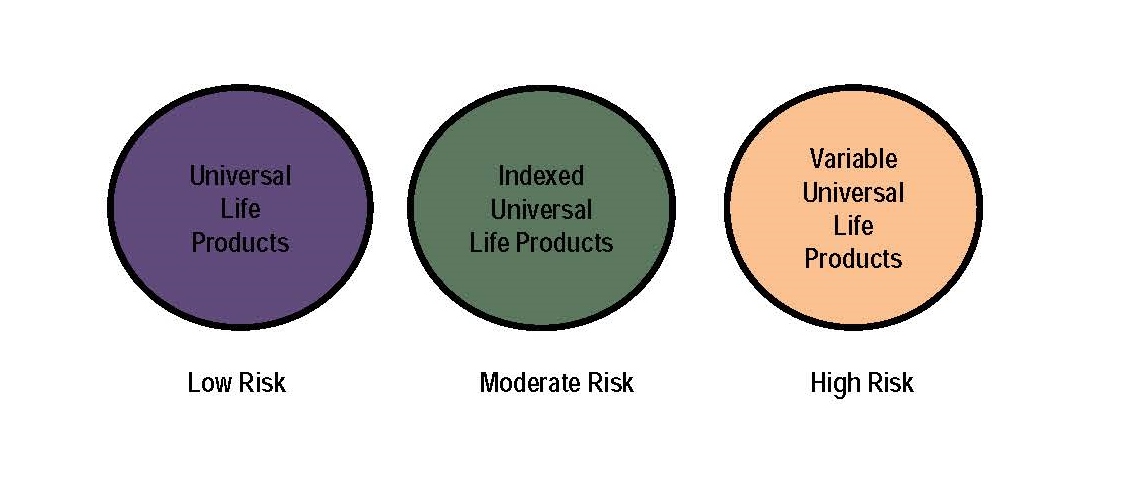

As we talked about earlier adjustable life insurance is just another name for a universal life insurance. Adjustable life insurance policies are attractive to those who want the protection and cash value benefits of permanent life insurance yet need or want some level of flexibility with policy features. Adjustable life insurance also comes with a feature that when you die your beneficiaries not only get the death benefit but can also receive what cash value remains.

Adjustable life insurance is an insurance option that makes it simple for policy holders to change the amount and scope of coverage offered by the policy while also modifying the monthly premium. Adjustable life insurance enables the owner to raise or lower the face amount as well as increase or decrease the insurance premiumas such the accumulated cash value of the adjustable life insurance policy will also vary. Adjustable life insurance definition if you are looking for low cost comprehensive insurance then we can provide you with multiple quotes to help you find a provider you are happy with.

Life insurance for which the policyholder can change the details of the plan including the face amount premium and coverage period. Features that can be adjusted include the face value of the policy the premium amount the benefits the coverage period and several other features.

Pacific Life Insurance Review For 2020 Pacific Life Product Details

Pacific Life Insurance Review For 2020 Pacific Life Product Details

How To Borrow From Your Life Insurance Policy 10 Steps

How To Borrow From Your Life Insurance Policy 10 Steps

Adjustable Life Insurance Policygenius

Adjustable Life Insurance Policygenius

Pros And Cons Of A Flexible Premium And Adjustable Life Insurance

Pros And Cons Of A Flexible Premium And Adjustable Life Insurance

Life Insurance For Seniors Top 7 Mistakes To Avoid Rates Faqs

Life Insurance For Seniors Top 7 Mistakes To Avoid Rates Faqs

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

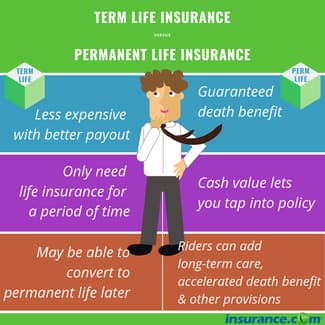

Life Insurance Term Vs Permanent

Life Insurance Term Vs Permanent

What Is Adjustable Life Insurance Definition By All Finance Terms

What Is Adjustable Life Insurance Definition By All Finance Terms

A Complete Guide To Life Insurance By Insurance Professionals Of

A Complete Guide To Life Insurance By Insurance Professionals Of

Aig Sample Illustrations For Critical Chronic Terminal Illness Ben

Aig Sample Illustrations For Critical Chronic Terminal Illness Ben

Pacific Premiercare Advantage Flexible Premium Adjustable Life

Pacific Premiercare Advantage Flexible Premium Adjustable Life

Term Vs Whole Life Insurance Which Is Best For You The Motley

Term Vs Whole Life Insurance Which Is Best For You The Motley

How To Rescue A Life Insurance Policy With A Loan

How To Rescue A Life Insurance Policy With A Loan

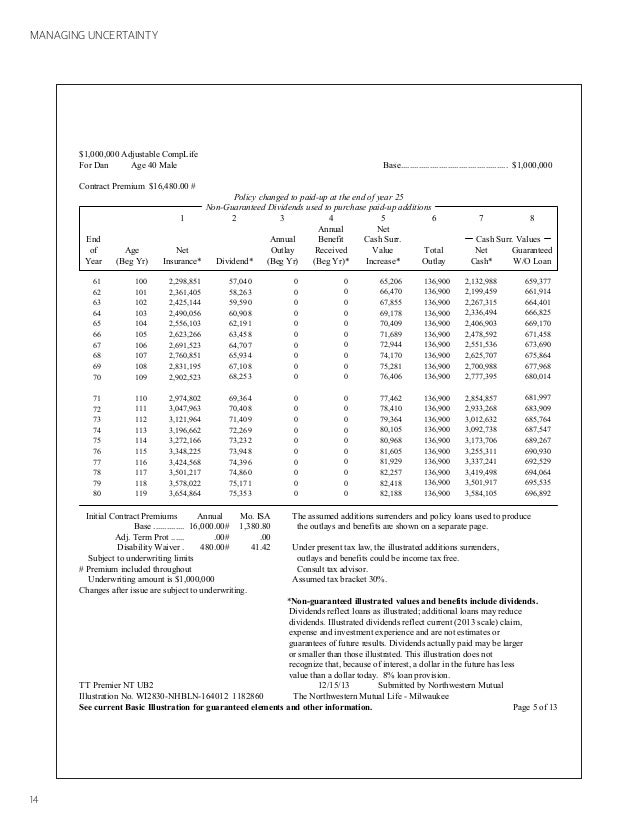

Life Insurance Illustration Pdf Free Download

Life Insurance Illustration Pdf Free Download

Why Almost Every Life Insurance Policy With Cash Value Stinks

Why Almost Every Life Insurance Policy With Cash Value Stinks

7 1 Adjustable Life What Is It Flexible Premium

7 1 Adjustable Life What Is It Flexible Premium

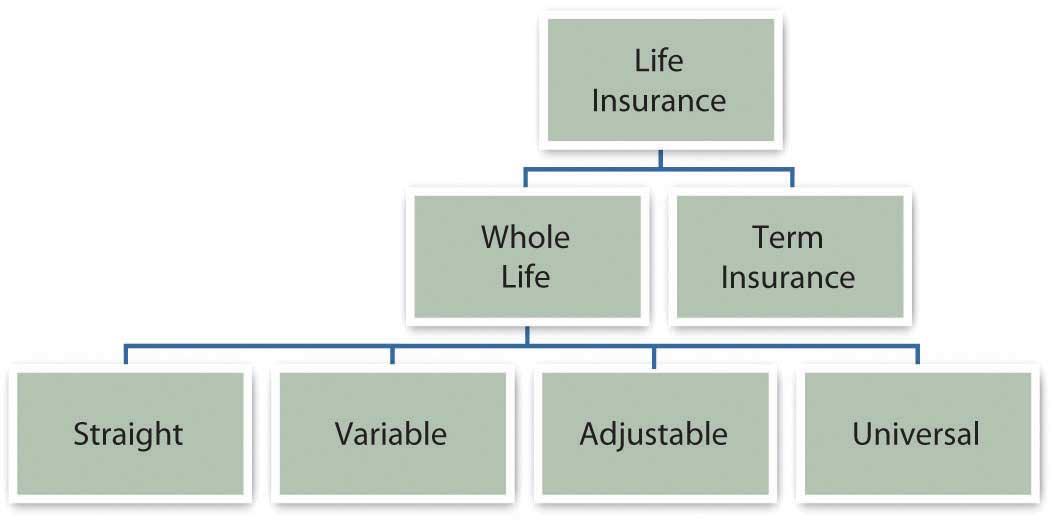

What Is Variable Life Insurance And How Is It Different

What Is Variable Life Insurance And How Is It Different

What Is Family Life Insurance And How To Buy Best Policy

What Is Family Life Insurance And How To Buy Best Policy

A Comprehensive Guide To Life Insurance David Pope Insurance

A Comprehensive Guide To Life Insurance David Pope Insurance

Comments

Post a Comment