But is accidental death and dismemberment coverage really a worthwhile investment and does it protect your family as well as you think. Accidental death and dismemberment insurance or add insurance protects you and your family if you get seriously injured or die due to an accident.

Some insurance brokers try to push accidental death and dismemberment insurance as a substitute for life insurance especially for young shoppers.

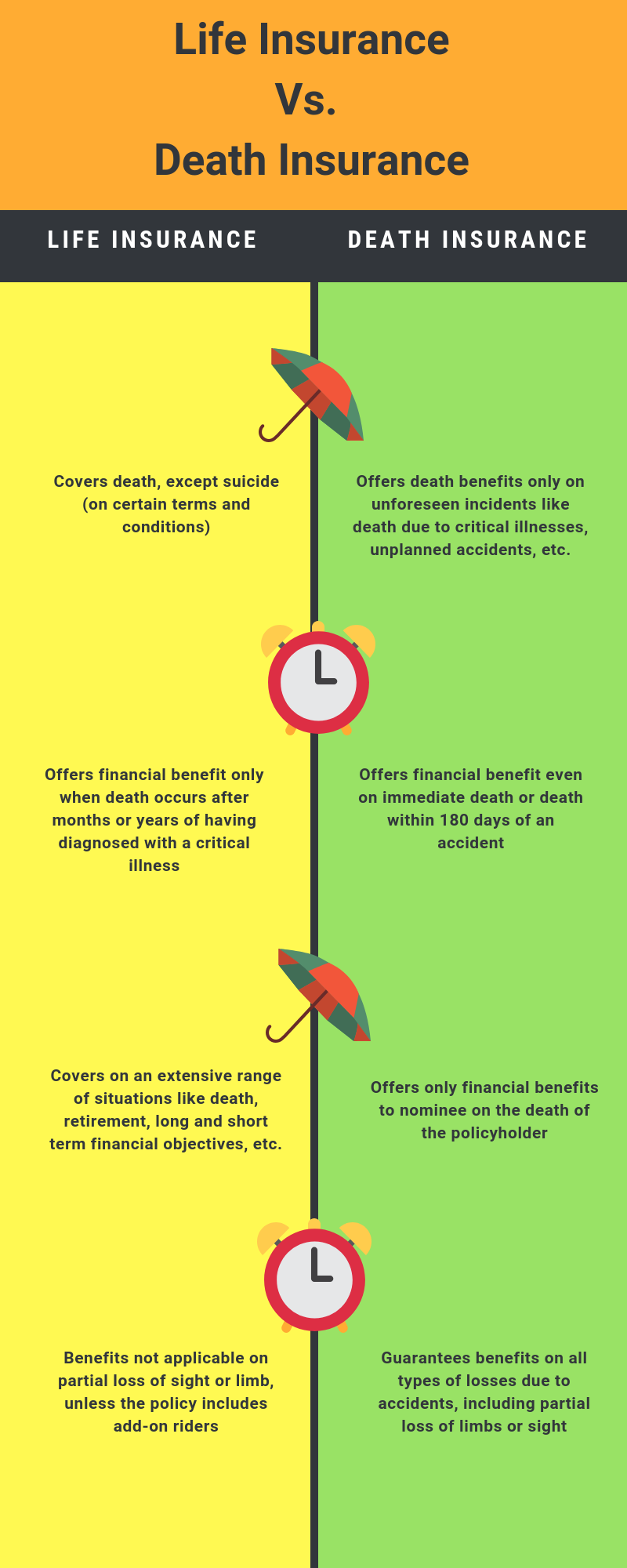

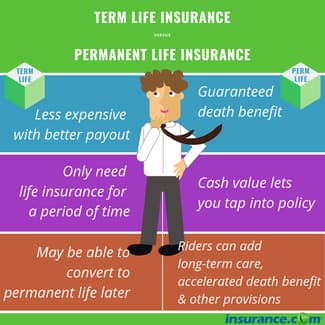

Accidental death and dismemberment insurance vs life insurance. While these options are similar and they do provide a death benefit there are some key differences between. Individuals that have an accidental death insurance policy can be a stand alone option or added to an existing life insurance policy. Accidental death and dismemberment coverage pays only if a death is accidental or you suffer a severe injury.

In general its best to start with life insurance and only add on accidental death and dismemberment insurance if its affordable. Accidental death coverage can be added to your regular life insurance in the form of a rider so that your life insurance policy pays extra if you are killed in an accident. Accidental death can be added as a rider to a traditional life insurance plan to pay out double death benefit in loss of life due to an accident aka double indemnity.

Accidental death policies pay a benefit when a death is the result of an accident. With life insurance your beneficiaries will get the payout regardless of how or when you die so it is much more reliable than add insurance. Accidental death insurance vs life insurance.

Pros and cons of accidental death and dismemberment policy add. When it comes to insuring your life you have the option between purchasing traditional life insurance and accidental death and dismemberment insurance. If purchased as a stand alone insurance policy accidental death insurance normally will come with dismemberment insurance.

Accidental death and dismemberment. Accidental death and dismemberment insurance. Since young people are more likely to die from accident than from illness or natural causes the argument is that add insurance is the smarter buy.

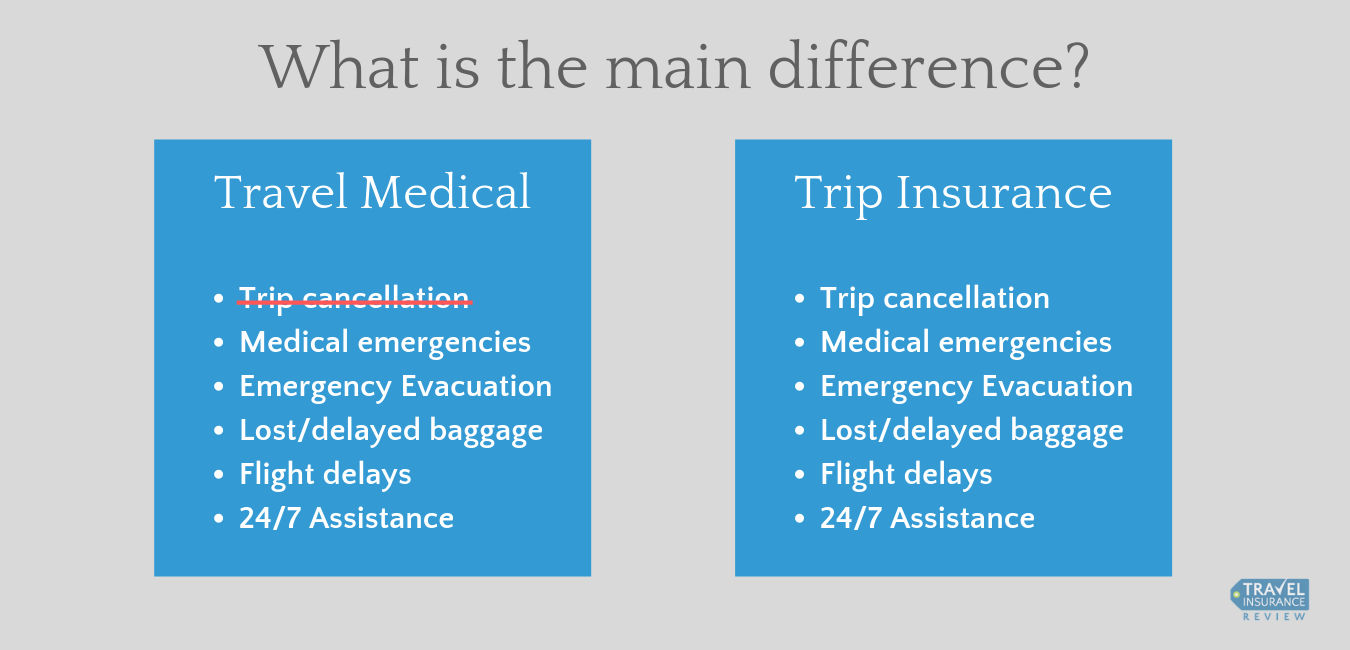

They aim to provide financial independence to insurer in the autumn years of life. Term life pays out whether a death is due to an accident illness or natural causes. Policies can be purchased when taking a trip or when an individual is performing certain types of.

If you arent familiar with the various kinds of death benefits or if this is your first time shopping around add and life insurance may sound very similar. Life insurance covers instances of death resulting from illnesses or natural causes which add insurance does not. There are a few main differences between life insurance and add insurance.

Life insurance typically provides more coverage than add insurance. Since this coverage is a limited form of life insurance the monthly premiums are reduced.

What Is Ad D Insurance And How To Get 2 000 Of Free Coverage

What Is Ad D Insurance And How To Get 2 000 Of Free Coverage

What Is Supplemental Life Insurance And Is It Worth The Cost

What Is Supplemental Life Insurance And Is It Worth The Cost

Hd Exclusive Accidental Death Life Insurance Quotes

Hd Exclusive Accidental Death Life Insurance Quotes

Glossary Of Life Insurance Terms Smartasset Com

Glossary Of Life Insurance Terms Smartasset Com

Group Life Insurance Group Life Insurance Vs Accidental Death And

Group Life Insurance Group Life Insurance Vs Accidental Death And

Accidental Death And Dismemberment Insurance Memorial Credit Union

Accidental Death And Dismemberment Insurance Memorial Credit Union

Term Life Insurance Vs Accidental Death Dismemberment Nerdwallet

Term Life Insurance Vs Accidental Death Dismemberment Nerdwallet

Term Life Insurance With Accidental Death And Dismemberment Rider

Term Life Insurance With Accidental Death And Dismemberment Rider

Sun Maxilink Prime Sun Life Vul Insurance With Investment

Sun Maxilink Prime Sun Life Vul Insurance With Investment

Accidental Death Versus Term Life Insurance Haven Life

Accidental Death Versus Term Life Insurance Haven Life

Here Is Why You Should Kiss Your Farmers Life Agent Goodbye Review

Here Is Why You Should Kiss Your Farmers Life Agent Goodbye Review

Life Insurance Vs Accidental Death Insurance Explained

Life Insurance Vs Accidental Death Insurance Explained

Accidental Death Dismemberment Ad D Travel Insurance Benefit

Accidental Death Dismemberment Ad D Travel Insurance Benefit

Accidental Death Claims Attorney Accidental Death Dismemberment

Accidental Death Claims Attorney Accidental Death Dismemberment

Life Insurance Vs Ad D Insurance Policygenius

Life Insurance Vs Ad D Insurance Policygenius

What Is Supplemental Life Insurance And Do You Need It Thestreet

What Is Supplemental Life Insurance And Do You Need It Thestreet

Accidental Death Versus Term Life Insurance Haven Life

Accidental Death Versus Term Life Insurance Haven Life

/GettyImages-889031464-bb987b976f9e4c29adbbdfd212d8059d.jpg) Is Your Employer Provided Life Insurance Coverage Enough

Is Your Employer Provided Life Insurance Coverage Enough

Comments

Post a Comment